Financial Access Initiative, 13 September 2012

I have written before how tiny Zidisha Microfinance is challenging long-held assumptions by leveraging internet social media and mobile payments like M-PESA to lend to clients without the help of loan officers or local staff. Since then, Zidisha has grown from tiny to small, with a portfolio now at $200,000, over 430 active borrowers, not to mention its 1400+ lenders. And, as before, its operations remain solid, with PAR30 at a respectable 6.6%[1] (check out its stats for more).

I’ve been advising Zidisha since before its launch in 2010, and with that had the opportunity to watch the evolution of the platform’s many innovations. One feature, introduced in August 2011, allows borrowers to request to reschedule their loans, regardless of whether they are delinquent or not.

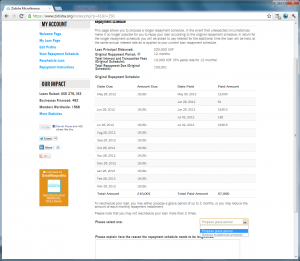

| Figure 1: Borrower rescheduling page (click to zoom) |

|

Zidisha’s online borrower portal provides two rescheduling options: adding a grace period of up to 2 months, but leaving the repayment amounts unchanged, or re-amortizing the loan over a longer period (up to 24 months) to lower the payment amount (Figure 1). The interest rate of the loan is applied over the longer period and repayment schedule is recalculated accordingly. Aside from these rules enforced through the website, there is no involvement or approval on the part of Zidisha – once a borrower submits the online request, his new repayment schedule becomes effective immediately.

So how has that been going? The results have challenged many of the traditional microfinance assumptions about zero-tolerance of delinquency or the importance of maintaining a strong “repayment culture.” With few exceptions, most MFIs would be deeply suspicious of attempts to reschedule a borrower’s loan based on nothing more than the borrower’s own request.

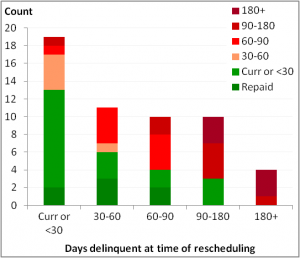

| Figure 2: Current status of rescheduled loans |

|

| Data as of Sep 6, 2012: * Excludes loans rescheduled in past 2 months. * Excludes loans where >10% of principal has been forgiven by Zidisha’s lenders (11 out of 51 rescheduled loans). Inclusion of such loans doesn’t significantly affect the results. |

Zidisha’s experience suggests that these suspicions might not be entirely appropriate. Among those borrowers who were current or slightly delinquent at the time they rescheduled, the reschedules proved reasonably successful, with 2/3rds of the loans being repaid or remaining current under the new schedule (Figure 2). However, most borrowers who waited to reschedule until they’d already fallen more than 30 days behind (when traditional MFI rescheduling often tends to take place), soon fell delinquent on their new schedules as well.

Why this disparity between loans rescheduled while current vs. delinquent? It seems that two factors are involved. First, borrowers who reschedule early may simply be better money managers than their procrastinating counterparts. Moreover, those who wait to reschedule may also be facing more serious cashflow problems, which makes it difficult to plan future payments. This is consistent with research into the psychology of scarcity, which suggests that the quality of decisions tends to suffer when they’re made under the pressure of scarcity – exactly the situation faced by a client seeking to reschedule.

A bulwark against excessive debt stress

Zidisha offers a useful lesson in dealing with debt stress. Zidisha is inherently a demand-driven platform – there is no one on staff with either the incentive or capacity to push loans onto wavering clients, as too often occurs elsewhere. Nevertheless, poor people’s lives are precarious, and temporary shortfalls in cashflow can create severe repayment stress, which is exactly what Zidisha’s rescheduling option aims to avoid.

Clients who fall behind do get the usual reminder calls and in some cases even visits by Zidisha’s local relationship volunteers. But these volunteers handle no money, nor have any incentive to pressure the client to repay. Instead, after understanding the situation, they can remind clients of the rescheduling option, and help them figure out a suitable repayment plan if needed. By rescheduling, clients can thus avoid the kind of undue sacrifices, such as taking children out of school or skimping on food, which they sometimes make to repay traditional microcredit providers. And without the need to take out additional loans to make repayments, they also avoid the dangerous slide towards long-term overindebtedness.

Besides limiting downside risk, such rescheduling may also increase the upside of greater returns from client business investments. A recent study has shown that loans provided with 2 months’ grace period increased client willingness to make riskier, but also higher yielding investments. And while in the study the grace period was at the beginning of the loan, one could reasonably extrapolate that by providing greater repayment flexibility, Zidisha may likewise be helping clients to increase their incomes.

Zidisha is far from the first lender to offer rescheduling as part of its delinquency management process. The most famous example, Grameen Bank’s flexi-loan program, is somewhat similar. Nevertheless, despite its initial intent, it’s unclear how much actual flexibility flexi-loans really offer. David Roodman’s analysis suggests that the program’s implementation may depend more on the needs and incentives of Grameen’s headquarters, branch staff, and the loan officers on the ground, than the needs of the borrowers themselves. So what about another well-known example, SafeSave’s P9? It’s true that it features fully flexible repayments, but because it combines both credit and savings, it’s difficult to compare it to Zidisha’s credit-only approach. Indeed, for simple loans, Zidisha is the only lender I know that places control of the repayment schedule entirely in borrowers’ hands.

Zidisha’s borrowers: in their own words

Because Zidisha is an online platform that interfaces directly with the borrowers, it provides useful insight into what motivates them to reschedule payments. As part of their request, borrowers are required to provide an explanation. Here are a few examples from clients who were less than 30 days delinquent at the time of their reschedule requests (current loan status in parentheses):

Mark Opondo (repaid): had a sick family member and used all the amount i had. in a months time i will be in a position to continue with the loan payment.

John Kamau (67 days late): i happened to give one of my customers goods on credit and he would settee his debt on Saturday every week. on one of the occasions he defaulted and when i contacted him he promised to pay which went on for some time. i got him and confiscated some of his equipments hence compelling him to pay his debt. this is the reason that has caused me not to honor my loan obligation on time culminating to my loan reschedule

Francis Mwangi (current; also rescheduled and repaid previous loan): hi, i am kindly requesting to lengthen the repament term to one and a half years, reasons being 1. i am required to buy a harddisk sony 60 DB camera worth ksh 30,000 for my daughter to use in her attachment as a jounalist at ktn tv (she is currently a 3rd year student at moi university). 2. being the planting month most farmers who are my customers r pressed hence my businesses are down.

Mercy Njeri (27 days late): I would like to reschedule my repayment period because of the following reason, My business has not been doing well because of the drought. We have been having a severe drought here and this has greatly affected my business. The sales are usually very high in April and I would like to use the revenues that I will get during this April season to make my repayments. The rains has also started thus business will be back to normal.

Paul Musembi (current): hi lenders, i am doing fine here in kenya only that currently i am pressed and would like pay ksh 2000 a month, this will only go for few months since i am planning my business to pick may be next year. due to heavy rains , there has been a delay in harvesting since no dry season has been experienced to favour the harvesting of grains. this has affected my business very much coz i mainly deal with buying of grains. but as soon as the dry season allows the farmers to harvest hope to repay in 15 months as suggested allow. hope to co-operate. paul

Hearing from the clients directly is one of the greatest advantages of Zidisha. I wish there was space to share more here (though you can always browse the site). I will just end with what I found the most poignant statement from Mercy Njogu, who, after describing her situation, pleaded:

“i wish you can even give me a waiver soon for am really differing with my husband because of this small loan.”

She repaid the loan six months after rescheduling.

Leave a Reply