If there’s one issue that’s most difficult for microfinance practitioners to explain to the lay public, it’s high interest rates. As Elisabeth Rhyne describes it, at some point the numbers get so high that people become outraged and stop listening altogether. Most recently, the issue was put back in the public eye through Hugh Sinclair’s Confessions of a Microfinance Heretic and the media coverage it has spurred.

With few exceptions, his critique that microfinance investors are investing in MFIs charging exorbitant interest rates has gone largely unanswered. That’s not a tenable position for the long-term. For a socially responsible fund, the case ought to be simple – if you have investments that you’d rather not have to publicly support and explain, then either those investments don’t belong in your portfolio or you should learn how to explain those investments.

Rates in excess of 100% (in APR terms) are not unknown in microfinance. MFTransparency has compiled pricing data in Tanzania, where the average rate (including compulsory deposits and insurance) is 91%, and a third of the loans are priced above 100%. Rates in nearby Zambia average above 100%.

So how does one approach dealing with high rates? Few observers question the propriety of the poor charging each other rates in excess of 100% or even over 200% (in APR terms), while enjoying saving returns as high as 60%, as is the case of Village Savings and Loan Associations (VSLAs). But when the question is how much of the profit goes to an MFI or its investors, moral sensibilities are awakened — the rich (or at least, the richer) shouldn’t be excessively profiting from the poor.

What is excessive profit, anyway?

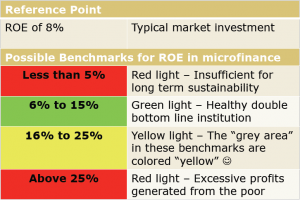

Recently, Chuck Waterfield posed the question directly: how much is too much? His answer comes in a set of return on equity (ROE) ranges, with 6-15% deemed reasonable, while 25% and above is deemed excessive (Figure 1).

| Figure 1: Chuck Waterfield’s proposed limits for responsible profit |

|

| source: Chuck Waterfield, Growth, Profitability, and Compensation - How Much is Too Much? |

By dealing with profit rather than interest rates, Waterfield gets to the heart of the matter. The simplicity of the ROE targets is attractive. However, it has two problems. First, while it’s commonly accepted to measure MFI profitability in terms of ROE, it’s less relevant for measuring effects on clients. It makes no difference to clients whether the MFI’s profits go to shareholders or creditors, yet ROE is heavily influenced by an MFI’s mix of equity and debt.

Second, the blanket approach doesn’t distinguish between efficient and inefficient MFIs. Indeed, by Waterfield’s standard, an MFI charging higher rates but generating less profit would be seen as more socially responsible than one charging lower rates, and generating more profit.

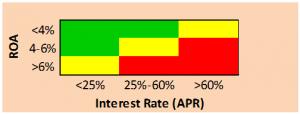

Because the two factors – rates and profit – are inextricably linked, I would like to propose an improvement to Waterfield’s proposal, what I call a Responsible Profit Matrix (Figure 2). First, my approach eliminates the distortions created by ROE by relying instead on return on assets (ROA), which is a more direct measure of the consumer surplus being captured by the MFI’s investors, whether through debt or equity.

| Figure 2: Responsible profit matrix |

|

Second, my proposed approach also takes into account interest rates so as not to punish efficient MFIs. For rates below 25% APR, any level of profit may be acceptable. Meanwhile, for MFIs charging a rate above 60%, a return on assets (ROA) over 4% would put the institution in the red zone – absent a good explanation, they should be considered beyond the pale for socially responsible investors. (A technical note: For this example, assuming a leverage ratio of 4:1, the mid-range of the matrix (25%-60% interest rate) is roughly equivalent to Waterfield’s proposed ROE levels.)

From theory to practice

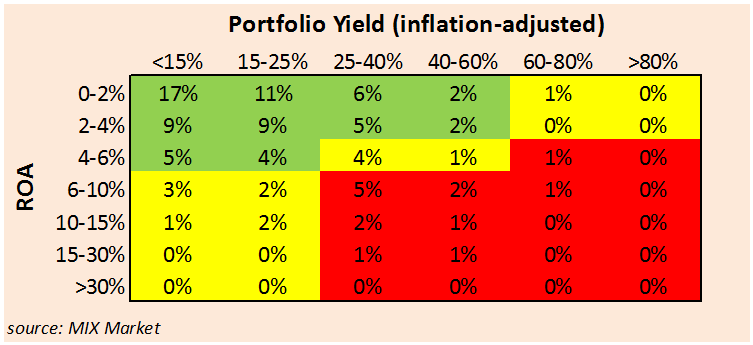

How does this compare with data from actual MFIs? The results appear at first glance to be fairly positive – 68% of MFIs fall in the green zone, while just 16% (131 out of a total of 836 that report the relevant data) fall in the red (Figure 3). The majority of these red-zone MFIs are also fairly close to the cutoff point, and it’s possible that a significant number of them could well have a reasonable explanation for the deviation – for example, the high earnings may be due to one-time asset sales, asset revaluations, or other non-operating income.

| Figure 3: Distribution of MFIs by ROA and portfolio yield |

|

Unfortunately, this picture masks a deeper problem. MIX doesn’t report actual interest rates, but only portfolio yield. While yield can be a rough proxy of interest, it doesn’t incorporate compulsory savings – a widespread practice that can substantially raise APR by forcing clients to pay interest on funds they can’t use. Worse yet, many MFIs in Sub-Saharan Africa – a region with one of the highest loan rates – don’t report to MIX at all. Remember that 91% average APR that MFTransparency found in Tanzania? That was based on data from 15 MFIs. Compare that to the MIX Market, which has ROA and yield data for only 6 MFIs, and the yield for these averages 44%, which is less than half of the MFTransparency figure.

Given these disparities, it’s not unreasonable to assume that a far higher number of MFIs – perhaps as many as a quarter of the total – may be in the red zone. That’s a level that suggests serious structural problems in the microfinance sector, raising doubts about the criteria that currently guide responsible investing.

Frankly, this is a startling conclusion. Could it be that the basic premise of the responsible profit framework is wrong? Let me address some of the main arguments against imposing a strict approach against high profits gained from high rates:

High profits may be needed to attract commercial investment. Recent experience of MFIs in India and elsewhere suggests that such a strategy may be deeply flawed. High profits certainly can attract commercial capital, but by doing so, they may well push MFIs to lend beyond clients’ borrowing capacity, leading to overindebtedness and setting the stage for eventual market collapse.

High profits may be needed to fuel MFI growth. This is a point that was raised by Richard Rosenberg in 2007, in a case study of the Compartamos IPO. Rosenberg questioned Compartamos’ reliance on high interest income to generate growth, instead of raising capital from outside investors. Already then, Rosenberg arrived at a surprisingly strong conclusion: “it is hard to avoid serious questions about whether Compartamos’ interest rate policy and funding decisions gave appropriate weight to its clients’ interests when they conflicted with the financial and other interests of the shareholders” [emphasis in original]. Given the shift in how microfinance is viewed today – outreach is no longer seen as an unquestioned good, and the use of microcredit as a tool for automatic poverty alleviation has been put in serious doubt – Rosenberg’s skepticism over this strategy resonates even more than it did five years ago.

High profits attract new entrants and fuel competition that brings down rates. One example cited by the 2009 CGAP paper is Bolivia, which saw a dramatic decline in MFI rates from 60% (EIR) in the early 1990s to less than 20% by 2007. It also cited a 2007 analysis by Blaine Stephens, which found a similar trend in four competitive markets, where operating costs and prices consistently declined during 2003-05. However, the issue is hardly clear cut. Of the four markets evaluated – Bosnia, India, Morocco, and Peru – three subsequently experienced a severe crisis brought on by over-saturation. Bolivia also experienced its own serious repayment crisis in the late 1990s. Thus, while high profits may bring competition and lower rates, that seems to come at a price of high risk of overlending, with severe repercussions to both MFIs and their clients. Lowering rates and moderating growth seems to be a strategy that is both more sustainable and more socially responsible.

A call for debate

The microfinance sector today is going through a critical phase. Where it emerges 2-3 years from now remains to be seen, but if the sector is to retain its claim to social responsibility, the issue of profits and interest rates will need to be tackled head-on. Greeting the question with silence – the dominant response thus far – is a strategy that is neither wise nor advantageous. One should not fear a vigorous debate.

Daniel, I understand your point about ROA vs ROE, but on balance I prefer the latter. Yes, it makes no difference to the borrower whether money goes to shareholders’ profit or to cost of funds, but I suspect that line of argument proves too much: the same could be said about operating costs etc. In the increasing typical situation, the MFI is buying borrowed cash pretty much as a commodity, whose price is set by a market over which management has little control. And as the industry commercializes, fewer and fewer of the sources of debt capital have much say about the running of the MFI, including the setting of its interest rates. (Would we also regard the MFI’s landlord and fuel supplier as “investors” whose profits come out of the clients’ hide?)

The ROE is far and away the most discretionary piece of the equation, and for that reason I’m inclined to think it deserves the major focus. To evaluate the appropriateness of profit in ROA terms will make an MFI look better merely because funding costs in its market are lower. An MFI that funded itself mainly with tiny deposits on which it paid little or no interest would look especially good, even though this is typically a lousy arrangement from the borrowers’ perspective, because the full cost of the funds (including transaction costs) would almost always be higher than the cost of larger liabilities, especially wholesale liabilities.

As to your suggested matrix, it’s possible I’ve not understood it fully . But my impression is that it assumes that higher interest rates tie pretty closely with lower efficiency. This is indeed true using the common operating expense ratio, with portfolio as a demoninator. But that indicator is not a good way to evaluate management’s effectiveness at cost control: it punishes smaller loans way too much. I doubt that the interest rate/efficiency correlation holds up very well using more meaningful tests of efficiency. Operating costs divided by avg number of outstanding loans and expressed as a % of per capita income is little better measure, I think: it still contains loan size distortion, but it’s smaller.

I’m not aware of a good way to evaluate management’s effectiveness at operating cost control using widely available statistics. Even MFIs that appear to serve the same peer group can face significant and unavoidable cost differences — e.g., effects of client density. (Serving a sparser clientele makes an MFI look worse using either of the foregoing efficiency measures.) The only way I’ve ever been able to form a judgment is to look at the specific bundle of constraints faced by the MFI, which includes things found nowhere on the MIX. That said, it sure would be nice if some clever person could come up with an efficiency indicator that’s better for judging management than cost-per-dollar-lent and cost-per-client. You’re a clever person; how about it?

Anyway, the long and short of it is that I still vote for Chuck Waterfield’s general approach.

My one caveat is that I would frame the question not as “which MFIs are immorally gouging borrowers,” but rather “which MFIs are entitled to claim that they are engaged in a ‘social’ enterprise rather than just maximizing their returns. ” As Chuck would be the first to admit, one could quibble forever about the specific profit levels he chose as break points. But they don’t seem unreasonable to me, if one accepts the value of having some quick and dirty first approximation.

Best regards,

Rich

Rich,

thanks for your helpful thoughts. It’s a great discussion, so here are a few thoughts in response:

ROA vs. ROE: really, this is only a technical preference that makes no statement regarding the MFI’s ability to control its cost of funds (I agree, these are market prices that most MFIs cannot influence). The technical aspect has to do with leverage — for the same ROA level, a highly-levered MFI could generate a much higher ROE than a low-levered one (which is, btw, what Lehman et. al. were doing in the mid-2000s). Moreover, for same levels of leverage, the two measures would be perfectly correlated, no matter how the MFI is funded, be it small deposits or large borrowings. It’s a question of mathematical equivalence: ROE = ROA * (assets / equity). So ROA captures everything that ROE does, except it excludes the strictly technical aspect of leverage that has no bearing on the ultimate cost to the end-client.

The (Profit/Price) Matrix: I agree with you that this approach penalizes lenders with more costly operations (smaller loans, hard-to-reach areas). In fact, the matrix is driven not at all by looking at the MFI’s operations, but by perceptions — people tend to be much less tolerant of high profits being made from high interest rates than from low interest rates. And perceptions matter a lot. So, yes, maybe it’s unfair to MFIs operating in, say, Congo or Mexico. But that’s reality.

You’re also right that the matrix (or any profit ceiling) effectively gives a free pass to inefficient MFIs that charge a lot, even if they don’t profit much. However, existing measures of fair pricing (CPP/Smart Campaign) would capture excessive pricing anyway, regardless of whether its driven by high profits or inefficiency. The whole point of the price/profit matrix isn’t to set fair pricing, but to set fair profit. It assumes as given that the MFI had already been filtered for CPP compliance and builds on top of that. Compartamos pricing may be “fair” in the sense that it’s below market, but that doesn’t mean that its profits can be said to be “fair,” especially given that its price — as perceived by market outsiders — is still unquestionably very high.

As for finding a better efficiency metric, I guess I’m just less concerned about efficiency in the first place. With continuing maturation of the sector, the spread of “best-practice” operations, MIS, and so forth, I just don’t think the scale of the problem is anywhere close the level it was in the sector’s earlier days. To me, the problem of high profit MFIs (a la Compartamos) is much more relevant. So I’m quite happy to let investors and rating agencies make those determinations by examining the complex set of variables involved (market comparison, nature of operations, etc.) and see less need for a better industry-wide measure of efficiency.

Anyway, I hope this discussion benefits the sector in some way.

Best,

Daniel