It’s been over two years since the start of the great India insolvency. Four years since the Bosnia blight and No Pago Nicaragua. And nearly six years since the Morocco microfinance meltdown.

At this point, it’s reasonable to say that the first global crisis in microfinance has passed. Life is on the mend.

In a recent email, Alok Prasad, head of the Microfinance Institutions Network in India (MFIN) described its most recent quarterly report as “green shoots in evidence.” The numbers certainly bear him out. Elsewhere, investors speak of tightening their exposure to countries with overheating markets, pay attention to issues of overindebtedness, and are wary of the sort of runaway growth that was being posted by Indian MFIs back in 2008-10.

Development of sector-level infrastructure is likewise moving apace, with ever increasing credit bureau coverage of microfinance clients and increasing implementation of client protection practices. The recent launch of Client Protection Certification by the Smart Campaign is a major milestone, and initiatives for measuring and reporting social performance, such as the USSPM and the Microfinance Seal of Excellence are likewise moving ahead. This “soft” side of microfinance is more than just a bunch of feel-good measures. They should be just as important to hard-nosed risk management types, since they are quite effective at moderating the types of excesses that lead to unsustainable lending.

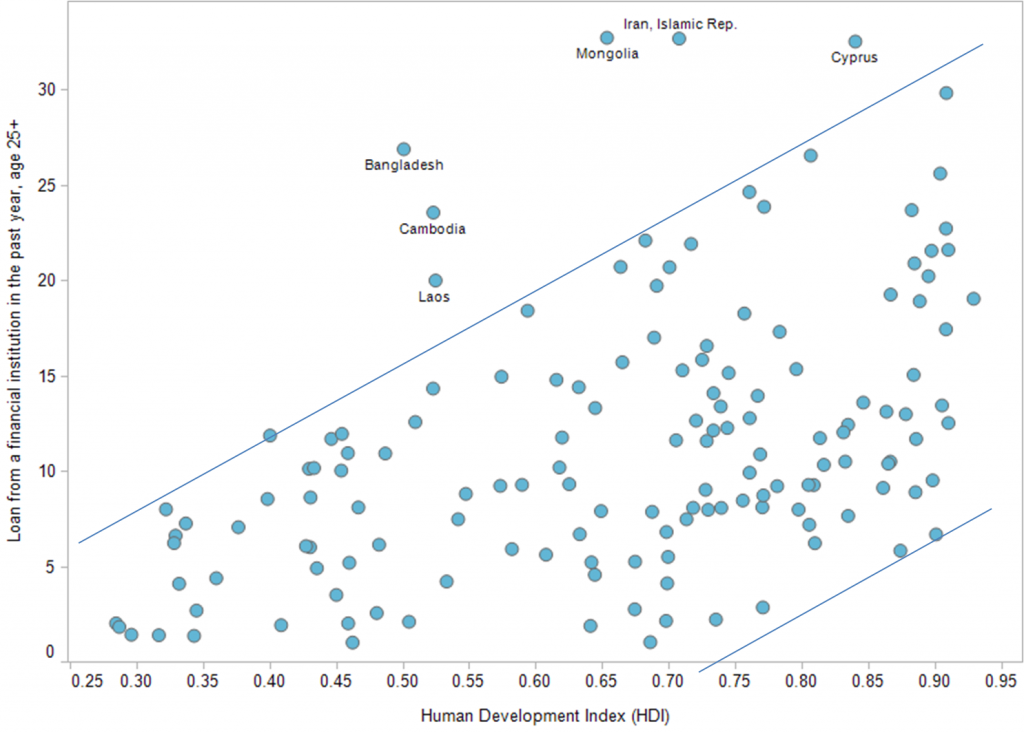

But despite these positive signs, there are good reasons to think that what’s next for the microfinance sector is potentially another repayment crisis. An upcoming Planet Rating report investigating market saturation (disclosure: I am a co-author) features this chart:

It shows the share of the adult population that has taken a formal loan in the past year and maps it against that country’s HDI. The lines are added to emphasize the visibly strong pattern: the rate of borrowing increases in line with a country’s level of development, even as it shows substantial variability between the two lines. But six countries clearly stand out, three of which – Cambodia, Bangladesh, and Mongolia – have particularly large microfinance sectors. Does that mean that these markets are overheated? Not automatically, though they certainly ought to give one pause.

It is thus particularly disconcerting to read news from Cambodia that the country’s microfinance sector has chalked up growth of 38% during 2012 on top of the already high borrowing rates reported in Findex 2011. This growth roughly parallels the growth in the number of borrowers (41% YoY in Q3 2012 – from CMA data), which means Findex data collected in 2011 likely understates current borrowing rates.

How much? This is harder to know, not least because it is almost certain that a large chunk of this growth came from customers who already had microfinance loans. The growth in the sector is likely being driven by multiple-lending. How many loans does the average Cambodian microfinance client have? This I don’t know, though presumably the recently set up Cambodian credit bureau might be able to shed light on that. Whatever that number is, one has to ask – is it sustainable?

Let’s take a look at another country – Mexico. According to Findex, Mexico is actually quite an under-penetrated market, with just 7.6% of adults (age 15+) having borrowed from a financial institution last year. So, no worries there, right? Not quite. The number of borrowers reported to the MIX Market in 2011 represents 7.4% of adult population – essentially identical to Findex. And yet, unlike Cambodia, Mexico’s commercial banking sector is large and well-developed, with extensive consumer operations. None of these banks are included in MIX’s data. Moreover, the number of MFIs in the country is far larger than the relatively small number of institutions reporting to MIX Market, meaning that MIX data is not only undercounting the total number of borrowers in the country, but is undercounting even the number of microfinance borrowers.

Taking the numbers at face value, it would appear that a relatively small number of MFIs are providing all of Mexico’s consumer credit. That would be the wrong conclusion. Instead, what we’re probably seeing is a result of multiple borrowing, with microfinance borrowers holding 2 or 3 loans being counted 2 or 3 times.

To confirm my suspicions, I called a team of Planet Rating analysts that work in the region. What I heard was frightening. In Chiapas, Mexico’s poorest state of 5 million, there are some 40 MFIs operating. Multiple borrowing is rampant, with the average urban client in the state carrying 4-5 loans, while clients with as many as 7 loans are not unheard of. The average microfinance loan size is 20% of per-capita GNI, but in impoverished Chiapas, that’s nearly 50% of the state’s per capita income. Very roughly speaking, that translates to liabilities of 2x or more of a typical client’s annual income owed in the form of short-term loans. Is that even remotely sustainable?

[Author’s correction: the stricken data above is incorrect — an error for which I take sole responsibility. Corrected data below, along with comparison to pre-crisis Andhra Pradesh data to provide context for the figures.]

The average microfinance loan size is 3.2% of per-capita GNI, but in impoverished Chiapas, that’s 8.0% of the state’s per capita income. Very roughly speaking, that translates to liabilities of at least 32% of a theoretical client’s annual income owed in short-term loans (recognizing that the average microfinance client’s income is likely to be below the state average). By comparison, loan sizes in Andhra Pradesh in 2010 were 11.5% of per capita GNI, while the rate of multiple borrowing in Chiapas is as bad or worse than was the case in Andhra Pradesh. Moreover, prevailing interest rates in Mexico are some 2-3 times higher than in India, which puts far greater stress on the clients’ repayment capacity for the same amount of debt. Put together, these figures imply that the bubble in Chiapas is worse than was the case in Andhra Pradesh on the eve of the crisis.

So is Chiapas the next Andhra Pradesh? At the surface it seems that the comparison doesn’t hold. Chiapas is not the crucible of Mexico’s microfinance market in the way that Andhra Pradesh was. A crisis in Chiapas would hurt the local lenders badly, but direct damage to the large lenders operating across the country would likely be limited.

However, Chiapas also differs from Andhra Pradesh in a way that is more concerning. India’s huge states (Andhra Pradesh alone is nearly the size of Mexico) are separated by language, caste, religion, as well as local media – differences that are especially strong among the poorer, less educated social segments that comprise microcredit customers. This regionalism played an important role in containing the Andhra Pradesh crisis within the state – a pattern also seen during an earlier repayment boycott in the Indian state of Karnataka.

But in a country like Mexico, with a strong national media, a common language, and fewer social barriers, it’s not hard to imagine a payment boycott in Chiapas easily spreading to other parts of the country, as was the case with the crisis in Nicaragua.

A place like Chiapas clearly has a deeply unstable credit market. All it takes is a small spark to set off a repayment crisis. The same could happen in Cambodia. Or maybe Mongolia (another country with very large rates of microfinance borrowing). Again we will read stories of clients drowning in debt, maybe stories of suicide. Whatever it is, the news won’t be good. But this will now be two years after Andhra Pradesh. One can surely expect the question: what have you guys been doing all this time?

As I described at the beginning, there has been important progress in a number of areas – credit bureaus, client protection, better risk management. But I fear all this may not be enough. We’re in a race, with unsustainable growth moving ahead, even as we try to put in place the brakes to slow it.

I don’t know how this race will turn out, but I fear that if we lose, the fallout this time may be greater than what anyone’s prepared for, especially if the crisis is of significant magnitude. Ultimately, the continuing viability of the microfinance sector depends on its reputation as an instrument for development and social improvement. That reputation has been damaged in the past few years, but the sector’s many efforts to improve – with credit bureaus, the Smart Campaign, and so on – have provided that all-important 2nd chance. A new overindebtedness crisis at this stage would undermine not just the sector’s reputation, but also those very initiatives.

Repairing that damage may well prove an impossible task.

[…] in India remains in protracted decline since 2010 (see graph), although talk of “green shoots” and catharsis after “near-death experience” has been around for some time. The […]

[…] in India remains in protracted decline since 2010 (see graph), although talk of “green shoots” and catharsis after “near-death experience” has been around for some time. The industry’s […]